Enterprise Zone Program

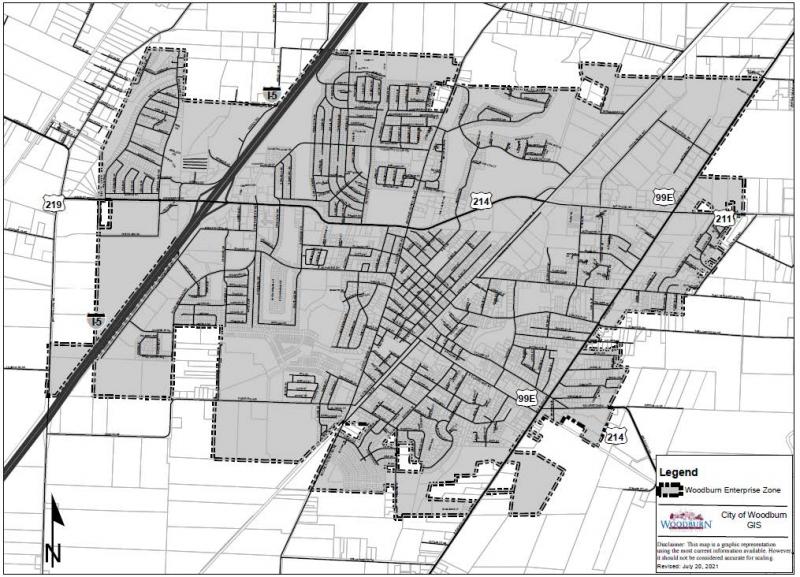

Designed to encourage business investment through property tax abatement, the Woodburn Enterprise Zone provides an abatement of property taxes to eligible businesses on qualifying investments for a period of three (3) up to five (5) years. The boundary of the Zone includes the entire city limits of Woodburn.

Standard incentives are available to eligible businesses in an enterprise zone, subject to authorization, timely filings and job creation criteria. Standard incentives include:

- Construction-in-Process Exemption - up to two years before qualified property is placed in service, it can be exempt from local taxes.

- Three to five consecutive years of property tax exemption on qualified property, after placed in service.

ENTERPRISE ZONE BOUNDARY MAP (Click for high-res copy)

BUSINESS ELIGIBILITY

Eligible businesses provide goods, products or services to other operations or organizations. This includes manufacturing and industrial activities as well as processing, distribution, maintenance facilities, warehouses and operations that handle bulk clerical or post-sale technical support.

Prior to investing in improvements or installing machinery/equipment on site, the Zone Manager must receive and approve an Application for Authorization, which contains pertinent process information.

QUALIFIED PROPERTY

A minimum investment of $50,000 in real property is required for enterprise zone consideration.

Real property qualifying for the exemption includes (but is not limited to): new building construction, structural modifications or additions, and newly installed machinery and equipment. Nonqualified items include land, previously used property value, vehicles, rolling stock, and miscellaneous personal items.

CRITERIA FOR QUALIFYING PROJECTS

For the standard three-year enterprise zone exemption, the business should meet the following criteria:

- Increase full-time, permanent employment by 10%

- Maintain minimum employment level during the exemption period

- Enter into a First-Source Hiring Agreement with local job training providers

- Satisfy pre-existing local zone conditions

Criteria for the extended tax exemption (for a maximum of a five-year exemption):

- The business should meet the criteria for the three-year enterprise zone exemption as well as the following:

- compensation of new workers must be at or above $87,108 annual wages (benefits can be used to reach this pay level);

- there must be local approval by written agreement with the local zone sponsor; and the company must meet any additional requirements that the local zone sponsor may reasonably request.

APPLICATION

Businesses interested in the Woodburn Enterprise Zone can contact the Zone Manager:

Jamie Johnk, Economic Development Director

City of Woodburn

270 Montgomery Street, Woodburn OR 97071

Phone: 503-980-6319

Email: jamie.johnk@ci.woodburn.or.us